Adjustments

In SW, Adjustment is a generic term that covers credits, refunds, bounced checks and movement of payments. It refers to an amount added to the work order that changes the Balance Due without changing the Amount Billed.

Credits

Credits are used to reduce the amount that a customer is expected to pay AFTER a work order has been finalized. Once a work order has been Finalized, the Amount Billed can no longer be changed. The original amount has been sent to QB and accounted for on a WSA.

If a work order has not been finalized, the Amount Billed can be changed on the Task of the work order or in the case of incorrect tax, by changing the tax authority on the work order.

Occasionally, there is a need to accept payment for less than what was originally quoted on a work order.

When to Issue a Credit

- Customer is dissatisfied with work that has been completed.

- No payment was made, leaving a balance.

- Partial payment was made, leaving a balance.

- Refund was given, leaving a balance.

- Warranty company sends a payment for an amount that is less than what was submitted.

- Request for payment from customer has been submitted several times and there is no reasonable expectation that payment will be made.

- Tax was incorrectly charged on a work order.

How to Issue a Credit:

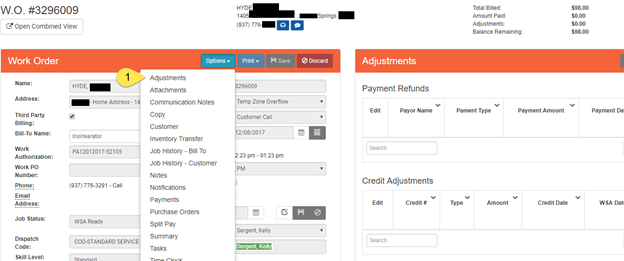

- On a work order that has been Finalized, select “Adjustments” from the Options.

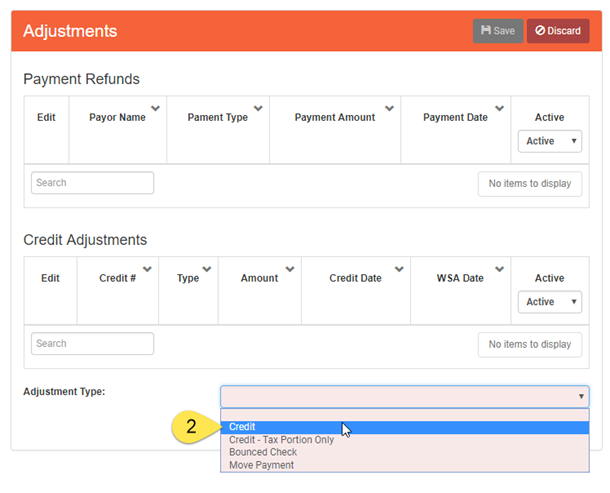

- Select the Adjustment Type "Credit" or "Credit-Tax Only" from the drop-down.

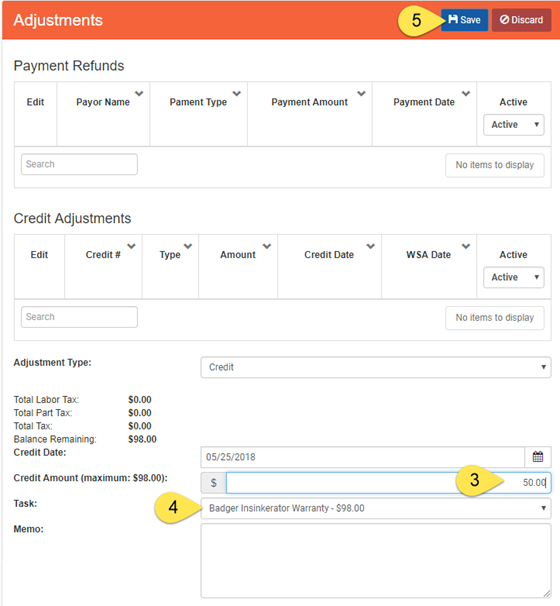

- Enter the desired amount for the credit to be issued.

- Select the task to which the credit should be applied.

- Save.

The Credit Adjustment is added to the work order, changing the Balance Due, while leaving the Amount Billed the same.

How a Credit is Split

When a credit is issued, the credit is automatically split between labor, parts and tax in the following ways:

- Labor Only, No Tax – the total amount of the Credit is applied to the labor.

- Labor Only, With Tax – Credit is split between Labor and Tax.

Labor = $65.00

Tax = $5.36

Amount Billed = $70.36

Balance Due = $70.36

Partial Credit of $20.00 is issued: Labor Credit = $18.48, Tax Credit = $1.52

65-18.48 = 46.52

46.52 * 0.0825(tax) = 3.84

5.36 – 3.84 = 1.52

Labor = $65.00

Tax = $5.36

Amount Billed = $70.36

Adjustment = $20.00

Balance Due = $50.36

Full Credit of $70.36 is issued: Tax Credit = $5.36, Labor Credit = $65.00

- Labor & Parts, Labor & Part Tax – Credit is Split between Labor, Labor Tax, Part & Part Tax.

Labor = $237.80

Part = $28.26

Labor Tax = $19.62

Part Tax = $2.33

Amount Billed = $288.01

Balance Due = $288.01

Partial Credit of $100.00 is issued: Tax Credit = $7.62, Labor Credit = $ 82.57, Part Credit = $ 9.81

- To apply the credit to only labor, issue the credit memo, then make the part credit inactive and apply the desired credit amount to the labor.

How Credits Affect WSA's and QBO

- Credit Memos are applied to WSA’s on the week they were created. The credit effectively reduces the weeks revenue by the credit amount. The revenue remains the same, but the credit is calculated on a separate line item to reduce the amount on which royalties are based.

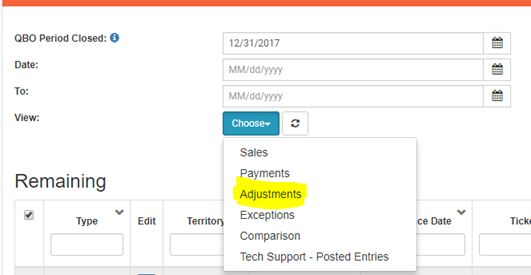

- Credit Memos are transferred to QBO when the ‘Adjustments’ are transferred on the QB Transfer screen.

How to Enter a Refund - Overpayment for a Negative Balance

A negative balance will occur if a customer pays more than the amount quoted on a work order. Here are a few examples of how this could happen:

-

-

- The customer is rounds the amount paid to an even number on a check

- A customer transposes numbers when writing a check.

- A customer pays $100 cash on a bill for $99.95.

The Refund-Overpayment option will only show as an Adjustment Type if there is a negative balance on the work order.

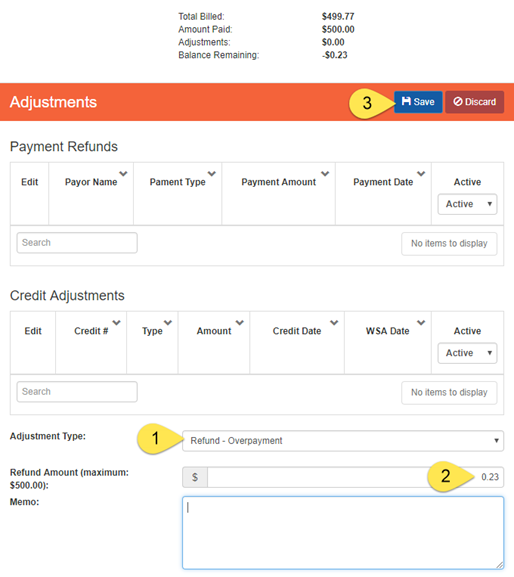

- Select the Adjustment Type of Refund-Overpayment.

- Enter the amount of the negative balance as a positive number.

- Save.

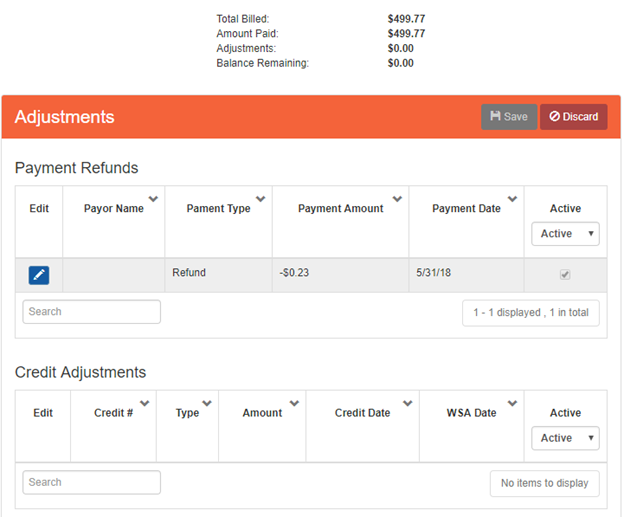

The Refund-Overpayment will bring the work order to a 0.00 balance.

How Refunds Affect WSA's and QBO

- Refunds have no bearing on WSA’s. The work order will show in AR if a corresponding credit was not issued and there is a balance on the work order, but once a work order has been sent on a WSA, it will never be on another one.

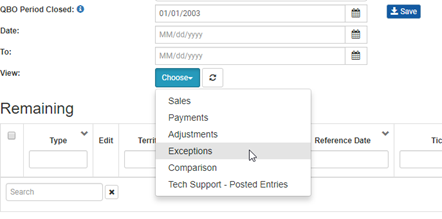

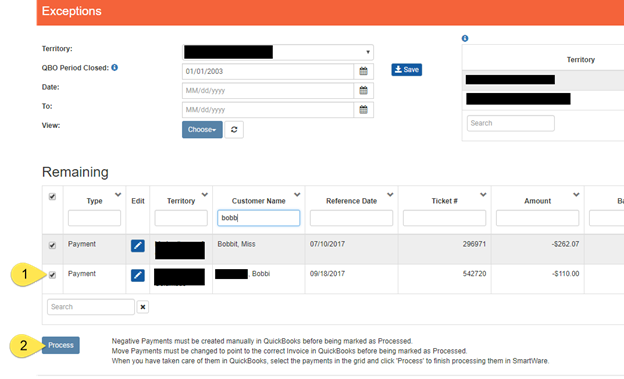

- Refunds do NOT transfer to QBO. Instead, they will show under ‘Exceptions’ on the QB Transfer screen. ‘Exceptions’ contain any amount that does not get transferred to QBO and must be entered into QBO manually. The Exceptions screen is simply a list to help the user keep up with what needs to be manually entered. Once an amount has been manually entered, check the box next to the amount and click on ‘Process’ at the bottom of the screen to remove it from the list.

Bounced Checks

Using the Bounced Check Adjustment Type allows the user to add an NSF fee to the work order after it has been Finalized.

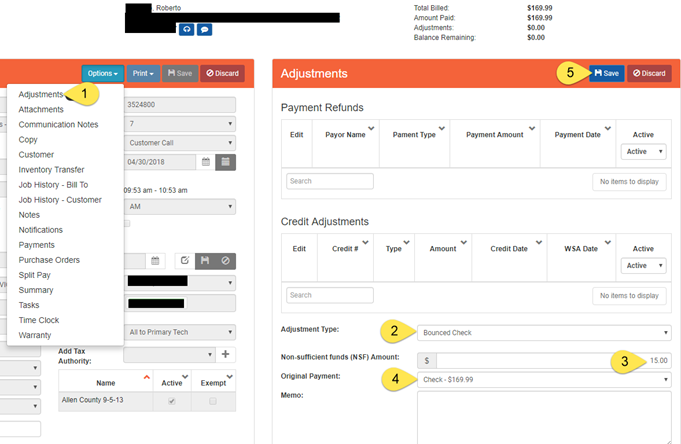

- Go to Options > Adjustments.

- Select Bounced Check from Adjustment Type.

- Enter NSF fee

- Select Original Payment for bounced check amount.

- Save.

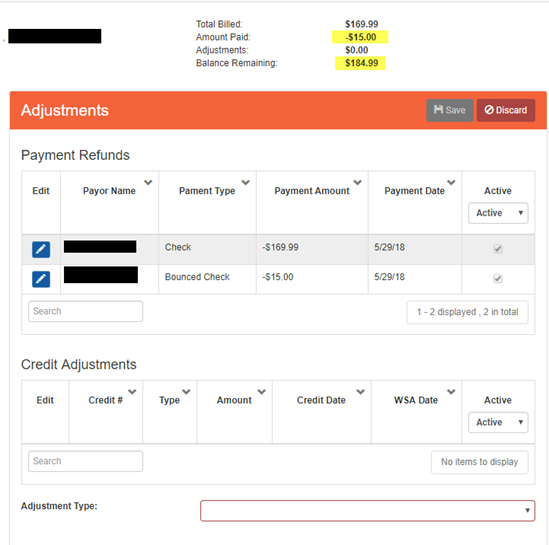

- This will change the Balance Due, including the NSF fee without changing the Amount Billed.

- Because these are now negative payment amounts, they will show under ‘Exceptions’ on the QB Transfer screen and will need to be added manually to QBO.

Move Payment

If a payment is added to the wrong work order, it can be moved to the correct work order using the ‘Move Payment’ adjustment type.

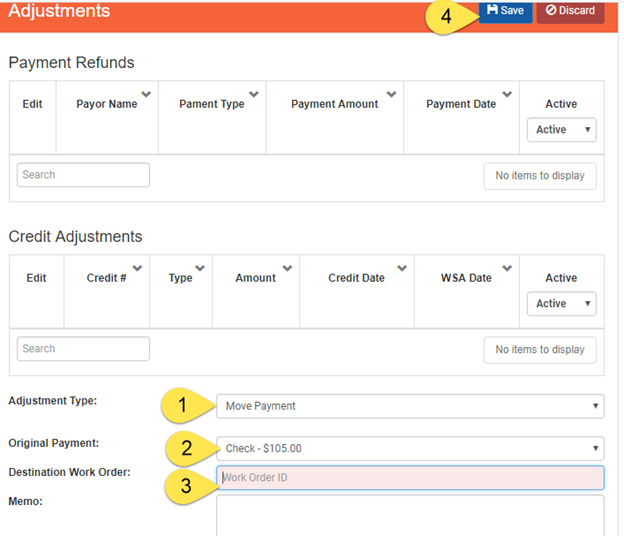

- Go to Options > Adjusments, select Move Payment.

- Select the Original Payment to move.

- Enter the Ticket# for the correct work order.

- Save.

-

If the payment has already been sent to QB associated with another work order, it will show under ‘Exceptions’ on the QB Transfer screen so that it can be manually adjusted in QBO.